Beyond backdating

In the midst of the stock option backdating scandal (also see here and here; may require subs.), Fortune's Justin Fox makes some interesting points about stock-options (via the excellent RealClearPolitics Blog):

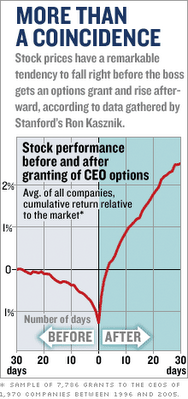

Yermack figured that this wasn't just luck, and theorized that companies were timing their grants to precede good-news announcements and follow negative ones. His findings began making the rounds in 1995, sparked a flurry of interest among finance and accounting scholars, and were published in The Journal of Finance in 1997.And a proposed solution for boards who want to remain above suspicion:Accounting professors David Aboody of UCLA and Ron Kasznik of Stanford followed up with an examination of companies that made options grants on more or less the same day every year, and found a similar stock price pattern. Their theory: Companies time releases of bad and good news to depress prices before the grants and boost them afterward.

[...]

Then there's the realization that, even before Lie's backdating bombshell, scholars suspected that executives were using insider information for financial gain in timing options grants and news releases.

Does that make backdating just the most obviously illegal tip of an iceberg of dodgy corporate behavior? And is anyone going to get in trouble for the other stuff?

Those are questions currently of great interest to securities lawyers, I learned at a late-October conference at Washington's Union Station. "Lucky Strikes" was the title of the event - organized by Stanford's Rock Center for Corporate Governance, of which Grundfest is faculty director - and much of the jargon was along similarly flip lines.

"Bullet dodging," for example, is the term for delaying options grants until just after the release of bad news (or moving up the release of bad news to precede an already scheduled grant). Because the grant comes after the news is out in the open, such behavior is nearly impossible to prosecute on insider-trading grounds.

More problematic is "spring-loading" - timing an options grant to precede the announcement of good news (or delaying the happy announcement to follow an already scheduled grant).

At Union Station, Grundfest divided this into "symmetric spring-loading," where the members of the board of directors who approve the grant are fully aware of the good news to come, and "asymmetric spring-loading," where they are not. Asymmetric spring-loading itself comes in two flavors: "with ratification," when the board says after the fact that it's okay, and without.

As Grundfest reeled off these terms, I and the reporter sitting next to me giggled, mainly because they sounded so much like something from a diving meet. ("She's going to attempt a reverse double asymmetric spring-loader and ... she nailed it!") But the distinctions may make all the difference, legally speaking.

In the meantime, Grundfest has been advising companies to schedule their options grants three trading days after a quarterly earnings announcement. This minimizes the amount of inside information that executives could possibly take advantage of. It also has the interesting side effect of giving them an incentive to miss the quarterly earnings target set by Wall Street analysts (because that might depress the strike price of their options). Now that would be a shocking development.Given the current furore, I expect a lot of companies will be following that advice.

No comments:

Post a Comment